Equipment Protection

PART I

CLAUSE 1 – PRELIMINARY INFORMATION

1.1. Acceptance of this insurance will be subject to risk analysis;

1.2. Only upon delivery of a proposal, completed and signed by the Insured, by his legal representative, or qualified insurance broker, this insurance may be contracted, amended, extended or renewed;

1.3. The registration of this plan at SUSEP does not imply, on the part of the Autarchy, an incentive or recommendation for its commercialization;

1.4. The Insured may consult the registration status of their insurance broker, on the website www.susep.gov.br, using their SUSEP registration number, full name, CNPJ or CPF;

1.5. Upon contracting this insurance, only those expressly ratified in the policy will be considered as contracted coverage, making any others described below null and void.

1.6. For situations not provided for in these Contractual Conditions, the laws that regulate insurance in Brazil will apply;

1.7. Upon contracting this insurance, the Insured accepts the limiting clauses found in the text of these Contractual Conditions.

CLAUSE 2 – PURPOSE OF THE INSURANCE

The purpose of this insurance is to guarantee the payment of indemnity to the insured for damages that he may suffer due to damage caused to machines, equipment and implements of the fixed or mobile type for NON-AGRICULTURAL USE, directly resulting from the occurrence of the foreseen and covered risks , relating to the Basic coverage and additional coverage contracted by him, under the “General Conditions”, “Special Conditions” and “Special Clauses” listed below, expressly and mandatorily agreed in this policy, within the Maximum Warranty Limit (LMG) of policy and the Maximum Indemnity Limits (LMI) set for each contracted coverage.

CLAUSE 3 – RISKS COVERED

3.1. For the purposes of this insurance, covered risks are those defined in the Special Conditions and/or Particular Conditions, applicable to the modalities and/or coverage effectively contracted, expressly ratified in the policy and in the endorsements referring thereto, and for which the Insured has paid the respective premium, respecting all the terms, provisions and exclusions contained in these General Conditions, Special Conditions and Particular Clauses, which form an integral and inseparable part of this policy.

3.1.1. If multiple and/or successive damages are associated with different triggering events, without there being the possibility of individualizing them with respect to those damages, in a perfectly defined cause and effect relationship, THE TOGETHER FORMED BY ALL OF THEM WILL BE INTERPRETED AS A SINGLE “INCIDENT” .

3.2. In the event of a claim covering two or more coverages, they will be treated independently, with the one that gave primary cause for the claim always prevailing.

3.3. Any disbursements demonstrably made by the Insured, resulting from Rescue Expenses during and/or after the occurrence of the covered accident with the objective of safeguarding and protecting the insured equipment, will also be guaranteed by this insurance, limited, however, to the Maximum Limit of Guarantee established in the policy.

3.3.1. It is understood and agreed that there is no deductible for these expenses.

of Rescue.

CLAUSE 4 – EXCLUDED RISKS

4.1. This insurance does not guarantee the interest of the Insured in relation to damages resulting, directly or indirectly, from:

a) intentional unlawful acts or serious negligence comparable to the intentional act committed by the Insured and/or controlling partners, directors, legal administrators, beneficiaries and their legal representatives, of one or the other;

b) poor quality or poor packaging of insured objects, undeclared intrinsic defect, or even declared by the Insured in the insurance proposal;

c) acts of public authorities, except to prevent the spread of damage covered by this policy;

d) acts of hostility or war, rebellion, insurrection, revolution, riot, confiscation, strike, nationalization, destruction or requisition resulting from any act of de facto or de jure authority, civil or military, and in general, any or all acts or consequence of these occurrences, as well as acts performed by any person acting on behalf of, or in connection with, any organization whose activities aim to overthrow the government by force or instigate its downfall, by disturbing the political and social order of the country, through of terrorist acts, revolutionary war, subversion and guerrilla warfare;

e) terrorist acts, the Insurer being responsible for proving it with proper documentation, accompanied by a detailed report that characterizes the nature of the event, regardless of its purpose, and provided that it has been recognized as an attack on public order by the competent public authority;

f) any loss or destruction or damage to any property, or any resulting loss or expense or any consequential damage and any legal liability of any nature, directly or indirectly caused by, resulting from or to which ionizing radiation or contamination has contributed by the radioactivity of any nuclear fuel or any nuclear waste resulting from the combustion of nuclear material. For purposes of this exclusion, “combustion” shall include any self-sustaining process of nuclear fission;

g) any loss, destruction, damage or legal liability directly or indirectly caused by, resulting from or contributed to by nuclear weapons material;

h) damage, liability or expense caused by, attributed to, or resulting from any chemical, biological, biochemical or electromagnetic weapon, as well as the use or operation as a means of causing damage, of any computer or program, system or computer virus, or any other electronic system;

i) any damage, damage, destruction, loss and/or liability claim, of any kind, nature or interest, provided that it is duly proven by the Insurer, which may be, directly or indirectly, originated from, or consist of failure or malfunction of any equipment and/or computer program and/or electronic data computing system to recognize and/or correctly interpret and/or process and/or distinguish and/or save any date as the real and correct calendar date, even if continue to function correctly after that date;

j) any act, failure, inadequacy, incapacity, inability or decision of the Insured or of a third party, related to the non-use or non-availability of any property or equipment of any type, type or quality, due to the risk of recognition, interpretation or calendar date processing. For all intents and purposes, computer equipment or software means electronic circuits, microchips, integrated circuits, microprocessors, embedded systems, hardware (computer equipment), software (programs used or to be used in computer equipment), firmware (programs residing in computerized equipment), programs, computers, data processing equipment, telecommunications systems or equipment or any other similar equipment, whether owned by the Insured or not;

k) lost profits, expected profits, fines, interest, financial charges of any kind and other indirect damages, even if resulting from one of the covered risks, unless expressly included;

l) natural wear and tear caused by use, gradual deterioration, inherent addiction, breakdown

mechanical or electronic, erosion, corrosion, incrustation, rust, humidity and rain, oxidation, fatigue, fermentation and/or natural or spontaneous combustion and end of life;

m) repair operations, adjustments and services in general for the maintenance of the guaranteed goods, except in the event of a fire

or explosion, in which case it will only be liable for loss or damage caused by such fire or explosion;

n) riots, strikes and lock-out;

o) theft, robbery, extortion, embezzlement and fraud committed against the Insured’s property by its employees or agents, tenants or assignees, legal representatives, whether acting on their own account or in conjunction with third parties;

p) delays of any kind or loss of market;

q) risks arising from illegal smuggling, transport or trade;

r) transfer of insured equipment between operating areas or storage locations by helicopter;

s) lifting operations of insured equipment, even if inside the construction site or storage location;

t) bursts, cuts and other damage caused to tires or inner tubes, as well as scratches on polished or painted surfaces, unless they result from an event covered by this policy;

u) overload, that is, load that exceeds the normal operating capacity of the insured equipment;

v) negligence, imprudence or malpractice of the Insured and its employees or agents in relation to the use of equipment and the means used to save and preserve them before, during or after the occurrence of any accident;

w) short circuit, overload, meltdown or other electrical disturbances caused to dynamos, alternators, motors, transformers, conductors, switches and other electrical accessories, except when additional coverage for Electrical Damage is contracted;

x) Simple theft without using violence and leaving no trace;

y) Qualified theft through abuse of trust and/or through fraud or dexterity and/or using a false key;

z) Operations of insured equipment in underground works or tunnel excavations;

aa) Damage to insured equipment near or over water, on piers, docks, bridges, locks, piers, rafts, pontoons, boats, platforms (floating or fixed), staking over water, or on beaches, riverbanks, dams, canals, lakes and ponds, as well as structures that pose a risk of the equipment falling into the water;

ab) Flooding and inundation, exclusively for Stationary Equipment;

ac) In the case of a legal entity, the provisions of items “a” and “o” apply to the controlling shareholders, their directors and administrators, the beneficiaries and their respective representatives;

ad) Damages and emerging expenses of any nature and other indirect damages, even if resulting from covered risks;

ae) Losses, damages or breakdowns caused to the Insured’s property by infiltration of water, sea air, mold, rust and corrosion, unless proven to be a result of a risk covered by this policy;

af) Acts performed by action or omission of the Insured, caused by bad faith;

ag) damage caused by contamination or pollution from any type of goods transported by the insured machines;

ah) fall, breakage, denting and scratching, unless arising from a covered risk, except damage resulting from a collision with a stump, which will not be covered by the coverage of this insurance;

ai) moral damages;

aj) Fire arising from an internal cause, including electrical damage;

ak) Operations of insured equipment on surfaces whose slope is greater than the maximum stipulated by the manufacturer.

al) Operation of the equipment by people who are not trained and qualified and who do not follow the rigging plan;

am) Use of the equipment outside the specifications determined by the manufacturer and/or damage resulting from extreme actions in an attempt to rescue/save the equipment, except when expressly authorized by the Insurer; an) Use of equipment exposed to abnormal and extreme conditions of operation, temperature and pressure, such as, but not limited to, operations on top of buildings; demolition operations of any structures or constructions; operations close to ovens and/or boilers and other operations that may compromise the manufacturer’s recommendations;

ao) Damage resulting from earthquakes, earthquakes, tidal waves and/or volcanic eruptions.

4.2. Any damage or loss caused to the following assets will not be covered by any coverage under this insurance contract:

a) wagons, locomotives, aircraft and vessels (including machinery, its component parts, accessories and objects transported, stored or installed therein);

b) trucks, cars, vans, scooters, motorcycles and any vehicles licensed for use on public roads or roads (including their parts, components, accessories and objects transported, stored or installed therein);

c) personal property and valuables inside the covered equipment;

d) software and/or data systems stored or processed in computer equipment;

e) films (developed or not) unless resulting from an accident covered by this policy;

f) tapes recorded (sound and/or video) by magnetic fields from any source;

g) any fixtures and/or permanent supports attached to the covered equipment; h) any equipment transported by third parties, while the Insured has not formally and effectively taken possession of it.

CLAUSE 5 – GEOGRAPHICAL SCOPE

5.1. The provisions of this insurance contract apply to all equipment operating or installed in Brazilian territory. Unless stipulated to the contrary in the Special Conditions of the coverage or Particulars of the policy.

CLAUSE 6 – CONTRACT METHOD

6.1. The coverage of this insurance may be contracted in the following ways, as provided in the Special Conditions:

6.1.1. Absolute Risk: in this form of contract, the Insurer is fully liable for losses arising from risks covered up to the respective Maximum Indemnity Limits (LMI), that is, losses that exceed the established deductible and/or mandatory participation of the insured, if any.

6.1.2. Total Risk: in this form of contract, the Insured at the time of contracting establishes the Maximum Indemnity Limit (LMI) corresponding to the real (current) value of the assets guaranteed by it. In the event of a claim guaranteed by this coverage, the Insurer will determine the real value of the assets (VRA) at the time and place of the claim and, if the LMI of the coverage insurance is lower than the VRA, the Insured will share in the losses proportionally, with application of the following apportionment clause:

Apportionment Clause

If, at the time of the claim, the current value of the equipment insured by this policy exceeds the respective Maximum Limit of Indemnity, the Insured will be considered co-insurer of the difference and will share in the losses in the proportion that fits him in apportionment.

Each insured equipment, if any, more than one in the policy, will be separately subject to this condition, and the Insured cannot claim excess of the Warranty Limit of one equipment to compensate another.

6.1.3. Relative Risk: in this form of contract, the Insured establishes a Maximum Indemnity Limit (LMI) corresponding to a percentage of the value at risk stated in the policy on the date of contracting. The percentage mentioned in this item must be

established in the Particular Conditions of this insurance, applying the following apportionment clause:

Apportionment Clause – First Relative Risk

Once the policy premium has been calculated based on the aggravation coefficient table adopted by the Insurer, coverage is given on a first relative risk basis, the Insurer being liable for covered losses that exceed the established deductible and/or mandatory participation of the Insured (if any) , up to the Maximum Indemnity Limit (LMI).

If the value at risk determined at the time of any claim is greater than the value at risk expressly stated in the Policy, the Insured will bear the proportional part of the losses corresponding to the difference between the premium paid and the appropriate premium, calculated based on the value in claim date risk.

If there is more than one piece of equipment insured in the policy, each amount will be separately subject to this condition, and the Insured cannot allege an excess of value at risk declared in one amount to compensate for the insufficiency in another.

If, however, the Maximum Indemnity Limit (LMI) stated in the policy corresponds to an index lower than 1% (one percent) of the value at risk determined at the time of the claim, the apportionment referred to in this clause will correspond to the difference between the value at risk declared for contracting the insurance and that determined at the time of the claim, maintaining the other provisions of the aforementioned item.

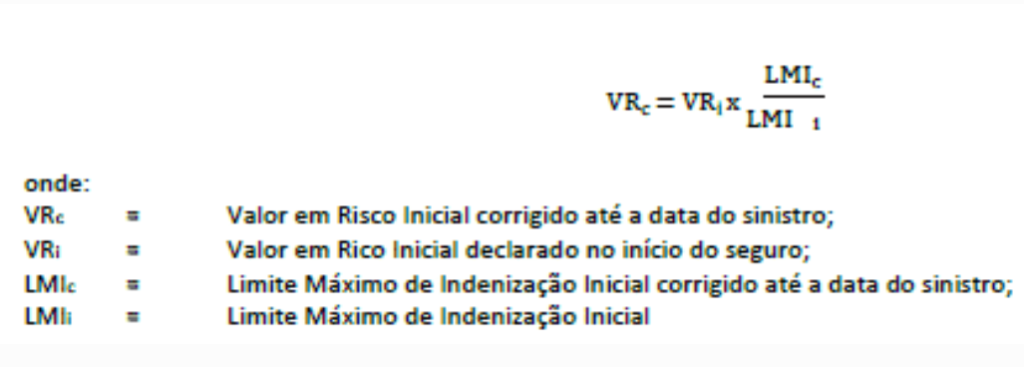

For apportionment purposes, the Initial Value at Risk restated up to the date of the claim will be obtained by the following expression:

CLAUSE 7a – INSURANCE DOCUMENTS

7.1. The proposal and the policy with its annexes and, when applicable, the risk inspection are documents of this insurance;

7.2. No changes to these documents will be valid if not made in writing and agreed by both contracting parties;

7.3. The presumption that the Insurer is aware of circumstances that are not contained in the documents mentioned in this Clause, and those that have not been communicated subsequently in the manner established in these Conditions, is not valid.

CLAUSE 8 – WARRANTY LIMITS

8.1. The Maximum Warranty Limit (LMG) of the policy is the maximum amount to be paid for this policy by the Insurer, depending on the occurrence, during the term of the policy, of one or more claims resulting from the same taxable event, covering one or more coverages contracted.

8.2. The Maximum Limit of Indemnity (LMI) is the maximum amount to be paid by the Insurer based on this policy, depending on the occurrence of a claim or series of claims guaranteed by the contracted coverage, respecting the Maximum Limit of Guarantee of the policy. 8.2.1. The Maximum Indemnity Limits contracted are specific to each coverage. In the event of a claim where the amount of damages determined exceeds the Maximum Indemnity Limit of the contracted coverage, the Insured may not request an excess of the Indemnity Limit of one piece of equipment to compensate for another.

8.3. The Limits provided for in this clause do not represent, under any circumstances, pre-assessment of the assets/interests guaranteed, it being understood and agreed that the amount of compensation to which the Insured will be entitled, based on these Conditions, cannot be

exceed the value of the asset/interest guaranteed at the time of the claim, regardless of any provision contained in this insurance.

8.4. All losses resulting from the same event will be considered as a single claim, regardless of the number of claimants.

8.5. When the policy contains more than one piece of equipment for the same coverage, the Maximum Indemnity Limit of this coverage will be applied to each piece of equipment separately.

8.6. In the event of a claim, the indemnity amount paid by the Insurer will be automatically deducted from the Maximum Indemnity Limit of the affected coverage.

CLAUSE 9 – ACCEPTANCE OR REFUSAL OF THE INSURANCE PROPOSAL

9.1. The contracting, modification or renewal of this insurance must be done through a written proposal, which contains the essential elements for examination, acceptance or rejection of the proposed risk(s), as well as information on the existence of other insurance covering the same interests against the same risks (UNDER PENALTY OF LOSS OF RIGHT), signed by the applicant, its representative or by the insurance broker, provided that, at the express request of any of the above.;

9.2. The Insurer may request, simultaneously with the presentation of the proposal and, thus, forming an integral part of it, a questionnaire and/or information sheet for a better examination of the proposed risk(s);

9.3. The Insurer will obligatorily provide the applicant with a protocol identifying the proposal, as well as the date and time of receipt;

9.4. The Insurer will have a period of 15 (fifteen) days to analyze the proposal, counted from the date of its receipt, for new insurance, alterations that imply modifications of the risks originally accepted or for renewals, to accept it or not; 9.4.1. If the applicant is an individual, the period established in item 9.4 of this clause will be suspended if the Insurer requests additional documents for risk analysis, which can be done only once. Restarting its count from the first working day after the date on which these documents are delivered;

9.4.2. If the applicant is a legal entity, the period established in item 9.4 of this clause will be suspended if the Insurer, justifying the new request(s), more than once, requests additional documents for a better analysis of the proposed risk(s), restarting its count from the first business day after the date on which the documentation is delivered;

9.4.3. In the event that acceptance of the insurance proposal (new insurance, renewals or changes) depends on contracting or changing the optional reinsurance coverage, the period referred to in item 9.4 will be suspended until the reinsurer formally manifests itself, and the Insurer must communicate this fact , in writing, to the applicant, highlighting the consequent lack of coverage for the duration of the suspension. 9.4.3.1. In this case, the collection, in whole or in part, of the premium is prohibited.

9.5. The Insurer will notify the applicant, its representative or its broker, in writing, of non-acceptance of the proposal, specifying the reasons for refusal;

9.6. The absence of a written statement from the Insurer within the previously established deadlines will characterize the tacit acceptance of the insurance;

9.7. There has been an advance payment for future partial or full premium payment, a conditional coverage period begins. In case of non-acceptance, the insurance coverage will still be valid for 2 (two) business days from the date on which the applicant, its representative or the insurance broker is formally aware of the refusal, and must be refunded to the applicant, within within a maximum period of 10 (ten) calendar days, the amount of the advance, deducting the “pro rata temporis” installment corresponding to the period in which the coverage prevailed; if it exceeds 10 (ten) consecutive days, the amount to be refunded will be subject to monetary restatement by the Extended Consumer Price Index/Brazilian Institute of Geography and Statistics Foundation – IPCA/IBGE, from the date of formalization of the refusal;

9.8. The issuance of this policy, or the endorsement, will be made within 15 (fifteen) days, from the date of acceptance of the proposal;

9.8.1. The policy must contain, in addition to these General Conditions, the Special Conditions and the Particular Conditions for the coverage actually contracted, the following information:

a) identification of the Insurer with the respective CNPJ;

b) the SUSEP administrative process number that identifies the marketed plan; c) the start and end dates of its validity;

d) contracted coverage;

e) the Maximum Limit of Guarantee of the policy and the Maximum Limit of Indemnity, per contracted coverage.

CLAUSE 10 – TERM

10.1. Unless expressly stipulated to the contrary, this agreement will be in force for a period of 1 (one) year from 24 (twenty-four) hours on the days expressed as the beginning and end of the term respectively;

10.2. If the proposal has been received, with an advance payment for future partial or total payment of the premium, the insurance will be effective from the date the proposal is received by the Insurer;

10.3. If the proposal has been accepted, without an advance payment for future partial or total payment of the premium, it will be effective from the date of acceptance of the proposal or with a later date if requested by the proponent, its representative or insurance broker.

CLAUSE 11a – RENEWAL

11.1. The renewal of this insurance will not be automatic. The Insured, its representative and/or the insurance broker must send the renewal request to the Insurer up to 05 (five) days before the end of the term of this insurance, as well as the duly completed questionnaire(s), dated and signed and any financial or other information that the Insurer may request. Based on the analysis of this information, the Insurer will determine the new terms, conditions and amounts in which the Policy may or may not be renewed;

11.2. The Insurer must provide the applicant, its representative and/or the insurance broker, a protocol that identifies the renewal request received by it, with an indication of the date and time of its receipt;

11.3. The Insurer will have a period of up to 15 (fifteen) days to pronounce itself in case of rejection of the renewal proposal;

11.4. The period established in the previous item of this clause is suspended, according to the cases provided for in items 9.4.1,

9.4.2 and 9.4.3 of Clause 9a of the General Conditions of this policy;

11.5. After this period, without the Insurer having given any declaration in this regard, the renewal shall be understood as accepted by the Insurer, from the date foreseen as the beginning of the term.

CLAUSE 12a – PAYMENT OF THE INSURANCE PREMIUM

12.1. The insurance premium may be paid in cash or in installments, by agreement between the parties, through the banking network until the date provided for this purpose, and this payment, as agreed between the parties in the act of contracting the policy or endorsement, may be made through a bank slip, or by other forms allowed by law; 12.2. The Insurer will forward to the Insured, his representative or, at the express request of any of them, to the insurance broker, a document for collecting the premium or its installments up to 5 (five) business days before the due date of the respective document;

12.3. If the Insured, its legal representative or the insurance broker, do not receive the billing documents within the period referred to in sub-item 12.2, instructions on how to proceed to make the payment before the deadline must be requested in writing from the Insurer.

12.4. In the event of the previous sub-item, if the requested instructions are not received in a timely manner, the due date will be renegotiated by the parties, at no cost to the insured.

12.5. When the deadline falls on a day when there are no banking hours, the payment of the premium, in a single or fractional installment, may be made on the 1st (first) following business day;

12.6. The payment of the premium, or its installments, when fractioned, must be made in the banking network or in places authorized by the Insurer, through a billing document issued by the Insurer, which will contain, at least, the following

information, regardless of others that are required by the regulations in force:

– name of the Insured;

– value of the prize;

– date of issue;

– proposal number;

– deadline for payment;

– Insurer’s checking account number;

– branch of the collecting bank, indicating that the premium can be paid at any branch of the same or other banks;

12.7. The deadline for payment of the premium will be the due date stipulated in the policy and/or endorsement, noting that for paying the premium through a bank slip, if there is more than one date provided for in this document, the last due date will prevail. date.

12.8. Respecting the provisions contained in the other items and subitems of this clause, if the claim occurs within the period stipulated for payment of the premium in a single installment, or any of its installments in fractional premiums, the right to compensation will not be impaired. When the payment of the indemnity leads to the cancellation of the insurance contract, the premium installments due must be deducted from the indemnity amount, excluding the fractional surcharge.

12.9. In the case of contributory insurance, the non-transfer of premiums to the Insurer by the Policyholder will result in the cancellation of coverage under the terms of these conditions, and the Policyholder will be subject to legal sanctions.

12.10. Premium Payment in a Single Installment

12.10.1. The deadline for payment of the premium will be as stated in the billing document, not exceeding the 30th (thirtieth) day of issuance of the policy, amendments or endorsements which result in an increase in the premium;

12.10.2. After the deadlines defined in the previous items, without payment of the single installment when agreed in cash, it will imply the automatic cancellation of the policy and/or its endorsements, regardless of any judicial or extrajudicial interpellation, from the beginning of the term;

12.11. Premium Payment Through Fractionation

12.11.1. It is prohibited to charge any additional amount from the insured, as administrative cost of fractionation;

12.11.2. fractional interest cannot be increased during the installment period;

12.11.3. The premiums will be paid in successive installments, and the first installment cannot be paid in a period exceeding 30 (thirty) days, counted from the issuance of the policy, endorsement or amendment, as well as the due date of the last one cannot exceed the 30th (thirtieth) ) day before the expiration of this policy. In this case, the Insurer will make the necessary corrections to adjust the payment method chosen by the Insured, in order to comply with the provisions of this sub-item, including requiring the Insured to pay the premium upon delivery of the proposal to the Insurer, if applicable;

12.11.4. The Insured may pay the premium in installments in advance. In this case, the interest will be reduced proportionally, considering the number of installments upon settlement of the policy or endorsement.

12.11.5. Non-payment of the first installment, when divided, will result in the automatic cancellation of the policy and/or its endorsements, regardless of any judicial or extrajudicial interpellation, from the beginning of the term;

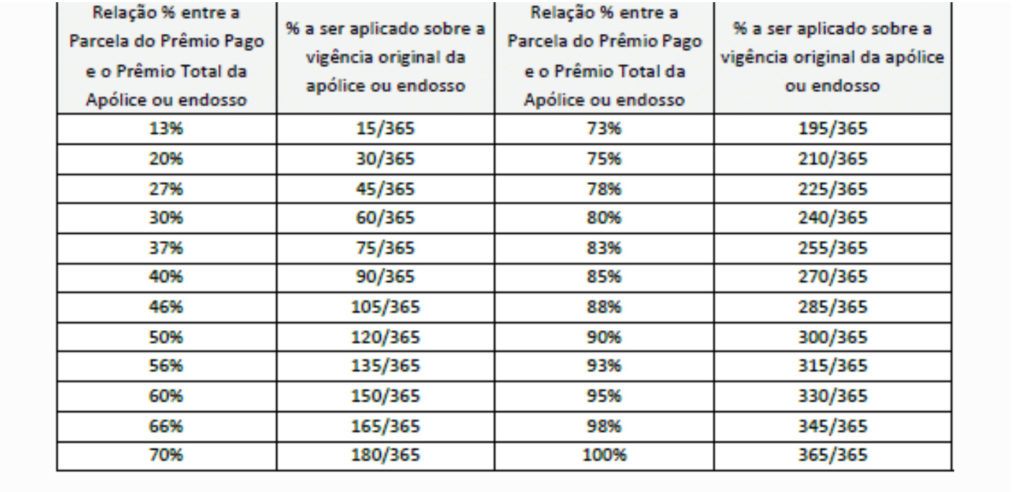

12.11.6. In the event of non-payment of any installment subsequent to the first, the insurance coverage period will be adjusted proportionally to the portion of the premium actually paid, as set out in the table below:

Note: For percentages not provided for in the table above, the immediately higher percentages must be applied.

12.11.7. The Insurer will inform highlighted in the billing document of each installment, the original term contracted and the new adjusted term that will be in force in the event of non-payment of each installment;

12.11.8. The Insured may reinstate the right to the contracted coverage, for the period initially agreed upon, provided that he resumes the payment of the premium due, within the period established in the previous paragraph, monetarily corrected in accordance with the legislation in force;

12.11.9. At the end of the period established by item 12.11.7 without the payment being restored, the policy will be canceled by operation of law, regardless of any judicial or extrajudicial interpellation;

12.11.10. The payment of amounts relating to monetary restatement and interest on arrears will be made regardless of notification or court order, in one go, together with the other amounts of pending installments;

12.11.11. In the case of fractionation in which the application of the short-term table does not result in a change in the term of coverage, the non-payment of any subsequent installment to the first will imply the cancellation of this policy by operation of law; 12.11.12. When the payment of the indemnity leads to the cancellation of this insurance contract, the installments due for the premium will be deducted from the indemnity amount, excluding the respective additional fractionation, related to these installments.

CLAUSE 13a – PROCEDURES AND SETTLEMENT OF CLAIMS

13.1. In the event of a claim that may be indemnified under this contract, the Insured, or whoever does so under penalty of losing the right to indemnity:

13.1.1. Give immediate notice to the Insurer, after becoming aware of its occurrence; 13.1.2. Use all the means at its disposal to minimize the consequences of the accident, preserve and save the damaged property, it being agreed that, IN THE EVENT OF NON-COMPLIANCE WITH THIS OBLIGATION, THE INSURER RESERVES THE RIGHT TO PROCEED WITH THE REDUCTION OF ITS LIABILITY IN SAME PROPORTION OF THE AGGRAVATION

LOSSES;

13.1.3. In order to determine the indemnifiable damages, the Insurer will use the examination and physical identification of remnants of the insured assets, physical traces, accounting, extra accounting controls eventually maintained by the insured establishment, as well as any other means of evidence available, provided they are reliable and admitted by law;

13.1.4. The Insured will provide the Insurer with a list of the damaged assets and proof of their pre-existence (invoices, accounting statements) or proof of ownership in the case of third party assets, a copy of the documents that

prove the Insured’s registration data, copy of the registration data documents of the beneficiaries or third parties involved, as well as records, controls, accounting records and other additional information, as well as granting, to the Insurer’s representative, access to the place of the claim, allowing him carrying out inspections and verifications necessary for the regulation and settlement of claims or any other fact related to this insurance;

13.1.5. Arrange for the preparation of a budget for replacement, reconstruction or repairs of damaged goods; request inspection of the claim to the Insurer and wait for it to be carried out, before starting any replacement, reconstruction or repair of these assets. FAILURE TO COMPLY WITH THIS OBLIGATION WILL EXONERATE THE INSURANCE COMPANY’S RESPONSIBILITY FOR PAYING INDEMNITY FOR DAMAGES CLAIMED BY THE INSURED OR BY THE INSURANCE BENEFICIARY, EXCEPT WHEN PREVIOUSLY AUTHORIZED BY THE INSURER, IN WRITING, THE REPLACEMENT, RECONSTRUCTION OR REPAIRS OF THE DAMAGED ASSETS WITHOUT BEING PERFORMED ADA THE INSPECTION OF CLAIM.

13.1.6. The Insured must provide the Insurer with the adoption of police, judicial and other measures, for the full elucidation of the facts, as well as provide all the collaboration that is requested, including providing certificates and certificates from the competent authorities, opening inquiries or proceedings filed for elucidation of the fact that produced the accident;

13.1.7. If there are well-founded and justifiable doubts, the Insurer is entitled, after analyzing the documents presented to it, to request new documents necessary for the elucidation of the fact that produced the accident. In this case, the counting of the period for payment of the indemnity defined in subitem 13.5.3 of this clause will be suspended from the moment the new documents are requested, and restarted from the business day after the one in which the documents are delivered to the Insurer requested by her;

13.1.8. EXCEPT FOR TRANSLATION AND OTHER EXPENSES CARRIED OUT DIRECTLY BY THE INSURER, all expenses incurred with proof of claim and qualification documents will be borne by the insured, the beneficiary of the insurance the, or its legal representatives;

13.1.9. The acts or measures taken by the Insurer, after the accident, do not matter, by themselves, in the recognition of the obligation to pay the indemnity claimed;

13.1.10. The Insurer reserves the right to proceed with the reduction of its liability in the same proportion of the aggravation of the damages, if it proves that they were increased due to the delay of the Insured, the beneficiary of the insurance, or the legal representatives of these people, in the presentation of the necessary documents for the determination of the losses and amount to be indemnified.

13.2. Calculation of Losses

13.2.1. In order to determine the indemnifiable damages in accordance with the Conditions expressed in this policy, the cost of repairing, recovering or replacing the damaged property will be taken as a basis, respecting its previous characteristics. Without prejudice to the provisions of Clause 8a of these General Conditions, the Insurer will also indemnify the cost of disassembly and reassembly that may be necessary to carry out the repairs, as well as the normal costs of transportation to and from the repair shop and customs expenses, if there is. If the repairs are carried out in the Insured’s own workshop, the Insurer will indemnify the cost of material and labor resulting from the repairs

performed plus a reasonable percentage of overhead expenses. For the purpose of indemnity, the Insurer will not make any reduction of losses, by way of depreciation, in relation to the repaired and/or replaced parts, it being understood, however, that the possible value attributed to the replaced parts must be deducted from the losses.

13.2.2. In any case, the indemnity will be limited to the current value of the damaged property, the current value being understood as the value of the property in its new condition, at current prices on the date immediately before the occurrence of the loss, less depreciation due to use, age and condition of conservation.

13.2.3. In any and all indemnities due, in compliance with all provisions of the insurance, the deductible and/or Mandatory Participation of the Insured, if applicable, and the value of any salvages that remain in the possession of the Insured shall be deducted; 13.2.4. Without prejudice to the provisions of Clause 8a of these General Conditions, import expenses and normal transport and assembly costs will be included in the new price. 13.3. saved

13.3.1. In the event of an accident that affects the assets described in this policy, the Insured will not be able to abandon the salvage and must immediately take all appropriate measures to protect them and reduce the damage.

13.3.2. The Insurer may, in agreement with the Insured, provide for the best use of the salvage, being, however, understood and agreed that any measures taken by the Insurer will not necessarily imply the recognition of the obligation to indemnify the damages occurred.

13.3.3. In the event that the Insurer makes use of the option to take possession of all or part of the salvage, the Insured is guaranteed the right to remove its emblems, guarantees, serial numbers, names and any other evidence of its interest in them or in relation to them. to themselves.

13.4. Subrogation of Rights

13.4.1. The Insurer, for the payment of the indemnity, whose receipt will be valid as an instrument of assignment, will be subrogated in all the rights and actions of the Insured against those who, by acts, facts or omissions, have caused the indemnified damages or that concurred for them, being able to demand from the Insured, at any time, the appropriate documents for the exercise of these rights.

13.4.2. With the exception of fraud, subrogation does not take place if the damage was caused by the spouse of the Insured, their descendants or ascendants, consanguineous or similar.

13.4.3. Any act by the Insured that reduces or extinguishes, to the detriment of the Insurer, the rights referred to in this condition is ineffective.

13.5. THE SETTLEMENT OF CLAIM COVERED BY THIS AGREEMENT WILL BE PROCESSED ACCORDING TO THE FOLLOWING RULES:

13.5.1. In the Claim Settlement Act, the Insured undertakes to present the following documents (from the Insured and the Beneficiaries):

LEGAL ENTITIES

ANONYMOUS SOCIETY

– Current Bylaws;

– Last Minutes of Election of the Executive Board and Board of Directors;

– Copy of the CNPJ Card;

– Copy of the CPF and RG or other identification document of the insured person’s representative with powers to contract, receive and give settlements.

LIMITED COMPANIES

– Social Contract and last amendment;

– Copy of the Power of Attorney granted by the company’s partners, to the appointed legal representative;

– Copy of the CNPJ Card;

– Copy of CPF and RG or another identification document of the insured person’s representative with powers to contract, receive and give settlements.

INDIVIDUALS

– Copy of CPF and RG or other identification document;

– Proof of residence (electricity bill and, failing that, any other supporting document).

CONDOMINIUMS

– Copy of the Bylaws of the Condominium;

– Copy of the last Minutes of election of the Trustee and Directors;

– Copy of the CPF and RG or other identification document of the liquidator;

– Copy of the CNPJ Card – it may happen that some condominiums do not have this document.

OTHER ENTITIES, SUCH AS POLITICAL PARTIES; CHURCHES; FOUNDATIONS; ETC.

– Copy of the Constitutive Acts filed with the competent special body;

– Copy of the last Minutes of election of the legal representative or power of attorney granted for this purpose;

– Copy of CNPJ (If any);

– Copy of the CPF and RG or other identification document of the legal representative, with powers to contract, receive and give discharges.

13.5.2. Once the indemnifiable damages have been determined and the corresponding indemnity fixed, the Insurer may, by agreement between the parties, pay the amount in cash, repair or through the replacement of damaged or destroyed goods, which will also imply full compliance with its obligations established in this safe. In any event, returning them to the state they were in immediately before the accident, up to the limits established for the respective coverage. For this purpose, the Insured is obliged to provide plans, drawings, specifications or other necessary information and explanations;

13.5.3. The Insurer will make the indemnity within a period of up to 30 (thirty) days, counting from the delivery of all documentation, including that of a complementary nature, which, in case of doubt, the Insurer deems necessary;

13.5.4. When the claim affects assets encumbered with any encumbrance, the Insurer will pay the indemnity directly to the Insured only in cases where the latter presents the competent authorization of the guarantee creditor or proves that he has already obtained the release of the encumbrance from him;

13.5.5. In the event of a claim that determines the payment of indemnity in the amount of the Maximum Indemnity Limit of the coverage contracted for the insured asset and the same being encumbered with any encumbrance, it is agreed that the respective indemnity will be paid by the Insurer to the guarantee creditor, and the Insured shall pay to the creditor the difference in the outstanding balance that exceeds the amount indemnified by the Insurer;

13.5.6. In the event of the death of the Insured, as an individual, or if he is unable to receive the indemnity, due to force majeure, the payment will be made in accordance with the provisions of the Brazilian Civil Code;

13.5.7. In the case of damaged assets that are rented or for those in which the policy has a beneficiary clause in favor of the legal owner, the indemnity will be paid, up to the financial limits of the parties involved. In this case, the discharge receipt must be signed by the insured and the beneficiary of the insurance.

13.5.8. If payment of the indemnity is not made within thirty days after carrying out the claim inspection and fulfillment by the insured, the beneficiary of the insurance, or the legal representative of one or the other, of all the requirements of the Insurer, the indemnity amounts are subject to interest of 1% per month and monetary restatement by the variation of the Index of Broad Consumer Prices – Brazilian Institute of Geography and Statistics Foundation – IPCA/IBGE or any other index that may replace it. Both calculated from the date of occurrence of the claim until the business day immediately prior to the effective settlement date of the claim.

CLAUSE 14a – TOTAL LOSS

14.1. For the purposes of this agreement, total loss will occur when:

a) the insured object is destroyed, or so extensively damaged that it no longer has the characteristics of the insured equipment;

b) the cost of repairing or recovering the damaged property reaches or exceeds 75% (seventy-five percent) of its current value, as defined in Clause 13 of these General Conditions.

14.2. In any case, compensation for Total Loss will be limited to the Current Value of the damaged property, as defined in Clause 13 of these General Conditions.

CLAUSE 15a – LOSS OF RIGHTS

15.1. In addition to the cases provided for by law, the Insurer will be exempt from any and all liability or obligation arising from this insurance, when:

15.1.1. The Insured, beneficiary, representative of either one or the other, or his

insurance broker, fails to fulfill the obligations agreed in this insurance contract;

15.1.2. There is fraud or attempted fraud, simulating a claim or intentionally aggravating the consequences of a claim, in order to obtain compensation;

15.1.3. The Insured, beneficiary, representative of either one or the other, or his insurance broker intentionally aggravates the risk;

15.1.4. If the claim is due to the intent of the Insured, beneficiary, representative of either one or the other, or his insurance broker;

15.1.5. The Insured, his representative or his broker does not inform the Insurer, as soon as he is aware, of any incident likely to considerably aggravate the covered risk, if it is proven that he remained silent in bad faith;

15.1.5.1. after receiving the notice of risk aggravation, the Insurer, within a period of 15 (fifteen) days counting from that notice, may terminate the contract, informing the Insured of its decision, in writing, or by agreement between the parties, restricting the contracted coverage;

15.1.5.2. the termination will only be effective 30 (thirty) days after the notification and the premium difference will be refunded by the Insurer, calculated proportionally to the period to elapse.

15.1.5.3. In the event of risk aggravation, the Insurer may propose the continuation of the contract and charge the premium difference.

15.1.6. The Insured, its representative or its insurance broker does not communicate the claim to the Insurer as soon as it becomes aware of it, as well as fails to take all appropriate measures to protect and mitigate the losses;

15.1.7. The Insured takes out new insurance on the same interests and against the same risks, without previously communicating its intention to the Insurer;

15.1.8. Failure to observe the Technical Standards issued by ABNT, INMETRO and/or other official bodies, as well as

recommendations issued by the manufacturer or all the rules and regulations in force for the proper functioning of the equipment;

15.2. It is also established that the insured, in addition to being obliged to pay the overdue premium, will lose his right to compensation if he, by himself, by his legal representative or insurance broker, makes inaccurate statements or omits circumstances that may influence the acceptance of the proposal. or the value of the prize. It is, however, agreed that if the inaccuracy or omission of the statements does not result from the Insured’s bad faith, the Insurer, at its option, may:

15.2.1. In the event of non-occurrence of the accident:

a) Cancel the insurance, retaining, from the originally agreed premium, the portion proportional to the elapsed time;

b) Allow the continuity of the insurance, charging the appropriate premium difference or deducting it from the amount to be indemnified.

15.2.2. In the event of a claim without full indemnity, or that does not result in the exhaustion of the maximum indemnity limit and/or the aggregate limit:

a) Cancel the insurance, after payment of the indemnity, withholding from the originally agreed premium, plus the appropriate difference, the portion proportional to the elapsed time;

b) Allow the continuity of the insurance, charging the appropriate premium difference or deducting it from the amount to be indemnified.

15.2.3. In the event of a claim with full indemnity, or that results in the exhaustion of the maximum indemnity limit and/or the aggregate limit:

a) cancel the insurance, after payment of the indemnity, deducting, from the amount to be indemnified, the difference in the applicable premium.

15.2.4. The possible indemnity may suffer a reduction in the premium paid/premium due ratio, if at the time of the claim it is verified that:

a) the classification of the equipment defined in the policy does not represent the real characteristic or use of the insured equipment at the time of the claim;

b) the protection system(s) (anti-theft system) that supported the discount on basic coverage and optional coverage for theft, were not in perfect working order.

CLAUSE 16a – INSPECTION

16.1. The Insurer reserves the right to carry out, during the term of the policy, an on-site inspection/inspection of equipment and other objects related to the Insurance and investigation of the circumstances relating thereto;

16.2.

The Insured must facilitate the execution of such measures by the Insurer, providing them with the evidence and explanations reasonably requested;

16.3. As a result of the inspection of the insured assets, the Insurer reserves the right at any time during the term of this policy, upon prior notification, to suspend coverage in the event of any serious situation or imminent danger, not informed when contracting the insurance. , or even if the Insured has not taken, after its discovery, the appropriate or recommended measures to remedy such situation;

16.4. In the event of suspension of coverage, the premium corresponding to the period in which coverage was suspended will be returned to the Insured, on a “pro-rata temporis” basis, updated according to the IPC/FIPE index, or another that may replace it.

16.4.1. The update will be carried out based on the positive variation calculated between the last index published before the date

obligation and the one published immediately prior to the effective settlement date.

16.5. As soon as the Insured takes the measures determined by the Insurer, the coverage may be rehabilitated under the terms originally contracted, or if applicable, under the terms of Clause 15.1.5.3 of these General Conditions.

CLAUSE 17 – TERMINATION AND CANCELLATION OF THE INSURANCE CONTRACT

17.1. The contracted policy may be cancelled, in whole or in part, at any time, in the cases provided for in clauses 9a, 12a and 15a, of these General Conditions, at the initiative of any of the contracting parties and obtaining the agreement of the other party, subject to the following provisions:

a) AT THE INSURED’S REQUEST, the Insurer will withhold, in addition to the fees, the premium calculated in accordance with the short-term table printed in Clause 12a – Payment of the Premium, subitem 12.8.5, of these General Conditions. For deadlines not foreseen in the short term table, the percentage corresponding to the immediately lower term will be considered.

b) BY INITIATIVE OF THE INSURER, in addition to the fees, the latter will withhold from the premium received, the proportion proportional to the time elapsed on a “pro-rata-temporis” basis.

c) Upon exhaustion of the policy’s Maximum Warranty Limit.

17.2. The insurance will be canceled automatically, leaving the Insurer exempt from any responsibility, when the indemnity or series of indemnities paid reach the Maximum Indemnity Limit of a certain coverage, the cancellation will only affect that coverage;

17.3. The amounts due for refund of premiums in the event of cancellation of the contract will be paid within a maximum period of 10 (ten) days and are subject to monetary restatement using the IPC/FIPE index, or the index that replaces it. The update will be carried out based on the positive variation calculated between the last index published, before the obligation’s due date, and that published immediately prior to the date of its effective settlement. From:

17.3.1. the date of receipt of the cancellation request, if it occurs at the initiative of the Insured;

17.3.2. the date of the effective cancellation, if it occurs at the initiative of the Insurer.

CLAUSE 18 – DEDUCTIBLE DEDUCTIBLE PARTICIPATION BY THE INSURED IN CASE OF CLAIM

In the case of a covered claim, and in accordance with the General and Special Clauses and Conditions of this contract, the Insured will participate in the first indemnifiable losses related to each claim, according to the percentages or amounts established at the time of contracting the insurance and specified for the respective deductibles stated in the policy.

CLAUSE 19 – REDUCTION AND REFUND OF THE MAXIMUM LIMIT OF INDEMNITY

19.1. During the term of this insurance, the Maximum Limit of Guarantee and the Maximum Limit of Indemnity will always be automatically reduced, from the date of occurrence of the claim, of the value of any and all indemnities that may be made, starting to be limited to the remaining amount, with the Insured not having the right to refund the premium corresponding to that reduction;

19.2. In the event of a claim, the reinstatement of the Maximum Limit of Guarantee and the Maximum Limit of Indemnity may be made, at the request of the Insured, and will be valid if the Insurer expresses its acceptance within 15 (fifteen) days, counting from the date of receipt of the request. The absence of manifestation by the Insurer within this period will imply its tacit acceptance.

19.2.1. In case of acceptance, the additional premium related to Reinstatement will be calculated from the date of occurrence of the claim until the end of the term of the policy.

CLAUSE 20 – CHANGES AND AGGRAVATION OF RISK

20.1. The Insured undertakes to communicate to the Insurer any and all alterations or modifications to the risk, the Insurer being exempt from liability for non-compliance with this provision, provided that the modification or alteration has resulted in an aggravation of the risk.

20.2. The changes listed below, occurring during the term of this

policy must be immediately and obligatorily communicated in writing by the Insured or whoever represents him to the Insurer, for risk reanalysis and eventual establishment of new contract bases:

a) correction or alteration of the registration data of the policy;

b) inclusion and exclusion of guarantees;

c) alteration of the firm’s corporate name or transmission to third parties of interest in the object insured;

d) alteration of the nature of the occupation carried out;

e) vacating or uninhabiting the insured buildings or that contain the insured goods for more than thirty days;

f) removal of insured property, in whole or in part, to a location other than that designated in the policy;

g) any civil works of renovation, expansion or structural alteration of the property where the insured equipment is located, admitting, however, small repair works intended for the maintenance of the property whose total value of the work does not exceed 5% (five percent) of the Maximum Indemnity Limit of the respective coverage.

20.3. The aggravation of the risk may or may not be accepted by the Insurer, applying the following provisions:

a) The Insurer will have 15 (fifteen) days to analyze the changes reported from the date on which it received the communication of the aggravation;

b) In case of non-acceptance, the Insurer will terminate the contract from the date subsequent to the period of 30 (thirty) days counted from the date of receipt by the Insured or his legal representative of the notification of refusal of the altered risk. In this case, the Insurer shall reimburse the Insured for the premium paid in proportion to the period of validity of the policy;

c) In case of acceptance, the Insurer will propose to the Insured the corresponding modification of the insurance contract, within

of the same period of 15 (fifteen days) mentioned in item “a” of this clause.

d) The Insured will have 15 (fifteen) days, after receiving the proposal, to accept or not.

e) In case of non-acceptance or silence by the Insured, the Insurer, after this period, may terminate the contract on the date subsequent to the period of 30 (thirty) days counted from the date of delivery of the counter-proposal presented by the Insurer. In this case, the Insurer shall refund to the Insured the premium paid proportionally to the period of validity of the policy.

CLAUSE 21 – POLICY COMPETITION

21.1. The Insured who, during the term of the contract, intends to obtain new insurance against the same risks, must communicate his intention, in advance, in writing, to all the insurance companies involved, under penalty of loss of right.

21.2. The total loss related to any claim covered by the other coverages will be constituted by the sum of the following installments:

a) salvage expenses, demonstrably incurred by the insured during and/or after the occurrence of the accident;

b) value referring to material damage, demonstrably caused by the insured and/or by third parties in an attempt to mitigate the damage or save the thing;

c) damages suffered by the insured property;

21.3. The indemnity relating to any claim may not exceed, under any circumstances,

the value of the loss linked to the considered coverage.

21.4. In the event of a claim covered by competing coverage, that is, that guarantee the same interests against the same risks, in different policies, the distribution of responsibility between the insurance companies involved must comply with the following provisions:

I – the individual indemnification of each coverage will be calculated as if the respective contract were the only one in force, considering, when applicable, deductibles, mandatory participations of the Insured, maximum indemnity limit of the coverage and apportionment clauses;

II – the “individual adjusted indemnity” of each coverage will be calculated, as indicated below:

a) if, for a given policy, it is verified that the sum of the indemnities corresponding to the various coverages covered by the claim is greater than its respective maximum guarantee limit, the individual indemnity of each coverage will be recalculated, thus determining the respective indemnity individually adjusted. For the purpose of this recalculation, the adjusted individual indemnities relating to coverage that does not present competition with other policies will be the largest possible, observing the respective damages and maximum indemnity limits. The remaining value of the policy’s maximum warranty limit will be distributed among the competing coverages, observing the damages and the maximum indemnity limits of these coverages.

b) Otherwise, the “adjusted individual indemnity” will be the individual indemnity, calculated in accordance with item I

of this article.

III – the sum of the adjusted individual indemnities of the competing coverages of different policies, related to common losses, calculated in accordance with item II of this article will be defined;

IV – if the amount referred to in item III of this article is equal to or less than the loss linked to concurrent coverage, each insurance company involved will participate with the respective adjusted individual compensation, the insured assuming responsibility for the difference, if any;

V – if the amount established in item III is greater than the losses linked to concurrent coverage, each insurance company involved will participate with a percentage of the losses corresponding to the ratio between the respective adjusted individual indemnity and the amount established in that item.

21.6. Subrogation relating to salvages will operate in the same proportion as each insurance company’s share of the indemnity paid.

21.7. Unless otherwise specified, the insurance company that participated with the greater part of the compensation will be in charge of negotiating the salvage and transferring the share, relative to the proceeds of this negotiation, to the other participants.

21.8. This clause does not apply to coverage that guarantees death and/or disability.

CLAUSE 22a – ASSIGNMENT OF RIGHTS

Nothing in this policy will give any rights against the Insurers to any person or persons other than the Insured. The Insurer will not be bound by any transfer or assignment of rights made by the Insured, unless and until the

Insurer, by way of endorsement, declares the insurance valid for the benefit of another person.

CLAUSE 23a – PRESCRIPTION

Since this contract is governed by the Civil Code and by the specific rules of each insurance, the statute of limitations determined by law applies.

CLAUSE 24a – JURISDICTION

25.1. For all matters resulting from this contract, the jurisdiction of the Insured’s domicile is competent;

25.2. In the event of non-existence of hyposufficiency between the parties, the election of a different forum will be valid.

PART II

GLOSSARY OF TECHNICAL TERMS

To facilitate the understanding of the terms used in this policy, we have included a list with the main technical terms used, which becomes an integral part of the Contractual Conditions.

ACCEPTANCE

Act of approval, by the Insurer, of the proposal submitted to it for contracting insurance.

EXTERNAL CAUSE ACCIDENT

One in which the triggering event of the claim is external to the property affected.

ADDITIVE

Supplementary provisions, added to a policy already issued, modifying it in some way

rma. Among the possibilities, we mention: changes in coverage, billing, additional premium, and extension of the validity period. The act that formalizes the inclusion of the additive in the policy is called “endorsement”.

RISK AGGRAVATION

Circumstances that increase the intensity or probability of occurrence of the risk assumed by the Insurer, whether or not the Insured wishes to do so.

POLICY

It is the instrument of the insurance contract by which the insured transfers to the insurer the responsibility for the risks, established therein, that may arise. The policy contains the general, special and particular clauses and conditions of the contracts, special coverage and annexes.

INCORRECT ACT

It is an intentional act performed with the intention of harming another.

TORT

It is every voluntary action or omission, or resulting from negligence, malpractice or imprudence that violates the rights of others or causes harm to others.

BREAKDOWN

It is the existing damage to the equipment before contracting the insurance.

CLAIM NOTICE

Means by which the Insured, a third party or their legal representative is obliged to do so, immediately after becoming aware of the fact.

RECIPIENT

Natural or legal person to whom the Insured recognizes the right to receive the indemnity, or part of it, owed by the insurance. Beneficiaries can be certain (determined) when nominally constituted in the policy, or uncertain (undetermined) when unknown at the time of contracting the insurance.

GOOD FAITH

In the insurance contract, it is the absolutely honest procedure that the Insured and the

Insurer, both acting with total transparency, free of vices, and convinced that they act in accordance with the law.

POLICY CANCELLATION

Early termination of the insurance contract, in its entirety, by legal determination, by agreement, due to default by the Insured, or partially, in relation to a certain coverage, by agreement or exhaustion of the maximum indemnity limit. The cancellation of the insurance, in whole or in part, by agreement between the parties, is called TERMINATION.

SPECIFIC CLAUSE

Set of clauses that alter the General and/or Special Conditions of this insurance, modifying or canceling existing provisions, or even introducing new provisions and possibly expanding or restricting coverage.

ROOF

In a broad sense, it is the set of covered risks listed in the policy. Strictly speaking, it is synonymous with Basic Coverage or Additional Coverage.

COLLISION

Collision or violent meeting of two bodies that occurred accidentally or disastrously, usually resulting in material damage.

ADVERSE WEATHER CONDITIONS

Precipitation in the form of water drops, snow or hail, or any other type of weather lasting and

enough impact to endanger the lives of people participating in the Event. CONTRACTUAL CONDITIONS

Set of contractual clauses that oblige and give rights to both the Insured and the Insurer. They are subdivided into General Conditions, Special Conditions and Particular Conditions.

SPECIAL CONDITIONS

Set of specific provisions relating to each type and/or coverage of insurance, which eventually change the General Conditions.

GENERAL CONDITIONS

Set of policy clauses that are generally applicable to all insurance of a particular branch or type of insurance or coverage, which establish the obligations and rights of the contracting parties.

INSURANCE BROKER

Individual or legal entity qualified by SUSEP to obtain and promote insurance contracts, pursuant to Decree Law No.73 of 11/21/1966.

It is up to the Broker to intermediate the intended insurance, as well as guide and clarify the Insured on the rights, obligations, limits and penalties provided for in this contract, responding legally.

PRODUCTION COST

All costs attributable to holding the Event, as defined in Value at Risk in these General Conditions.

BODILY INJURY

Any exclusively physical injury caused to the person’s body, including death or permanent disability.

PROPERTY DAMAGE

Any physical damage to tangible property, causing a decrease in equity, including all material losses related to the use of this same property.

MORAL DAMAGE

It is any offense or violation that does not harm a person’s assets, but his moral principles, such as those that refer to his freedom, his honor, his person or his family.

DEPRECIATION

It is the progressive loss of value of goods, movable or immovable, due to their use, age and condition.

ADDITIONAL EXPENSES

Any extraordinary expenses necessarily incurred by the Insured in the event of

postponement or interruption of an event, or the additional costs necessarily incurred to reduce or prevent the cancellation, interruption or postponement. Additional expenses do not include loss of earnings or profit.

“OVERHEAD” EXPENSES

These are indirect expenses incurred by the Insured for the repair, recovery or replacement of the damaged insured object.

Overhead expenses are also considered contingent expenses, that is, those additional expenses to the process of repair, recovery or replacement of the damaged property, excluding disassembly and reassembly, as well as transport of the insured object.

CALCULATED NET EXPENSES

Result of the sum of all costs and charges incurred by the Insured in organizing, carrying out and providing services for the insured event(s), including the cost of advertising, minus the gross revenue received or receivable and

minus any savings that the insured may make to reduce such losses in the event of cancellation, interruption or postponement of the event, or even in the event of non-attendance of the person designated in the policy.

FEES

It is the set of additional expenses that the insurer charges the insured person, corresponding to the installments of taxes and other charges to which the insurance is subject, such as the cost of the policy.

ENDORSEMENT OR AMENDMENT

Document through which the Insurer and the Insured agree to amend the insurance contract.

POLICY SPECIFICATION

Document that forms an integral part of the policy, in which the characteristics of the contracted insurance are specified.

STUDENT

Natural or legal person who contracts a collective insurance policy, being invested with the powers of representation of the Insured before the Insurer.

EVENT

It is any and all occurrence or event, arising from the same cause, liable to be guaranteed by an insurance policy.

EXTERNAL CAUSE EVENT

It is any and all material damage caused to the insured property that did not originate from this same property but from an external agent. It is the same as “External Cause Damage”.

COVERED EVENT

It is the future and uncertain event, of a sudden and unpredictable nature, foreseen in the coverage of this policy and occurred during the term of the insurance.

FORCE MAJEURE

Inevitable and irresistible event, that is, an event that could be predicted, but not controlled or avoided.

FORUM

Refers to the location of the Judiciary Body to be activated in the event of disputes arising from this contract.

FRANCHISE

Deductible means the value expressly defined in the insurance contract, for each coverage that is provided for, representing the Insured’s participation in the resulting losses of each claim. In this way, the Insurer’s liability begins only and only after reaching its limit. See also “Mandatory Insured Participation”.

QUALIFIED THEFT

Subtraction, for oneself or for others, of someone else’s movable property, practiced with the destruction or disruption of an obstacle, with abuse of trust, or through fraud, escalation or dexterity, using a false key and/or through competition between two or more people. An obstacle is understood as the material means that aims to prevent access to the insured property, and this means cannot be inherent or installed in the insured property itself.

SIMPLE THEFT

Subtraction, for oneself or for others, of someone else’s movable thing, without leaving any traces. Event not guaranteed by any of the coverages provided for in this insurance contract, that is, it is an excluded risk.

INSURED AMOUNT

Amount established by the Insured as the maximum limit of their right to compensation.

INDEMNITY

Term that defines the Insurer’s consideration, that is, the amount to be paid to the Insured or to the beneficiary of the insurance, in the event of occurrence of a risk covered in the policy. FULL INDEMNITY

Full indemnity will be characterized, when resulting from the same claim, the material damage caused to the insured property, reach or exceed the amount determined from the application of a determined percentage on the current value of the damaged property. Full indemnity is also known as “total loss”.

RISK INSPECTION (INSPECTION)

Inspection carried out by experts to verify the conditions of the object of insurance.

I.O.F.

Financial transaction tax.

CLAIMS SETTLEMENT

It is the process for paying indemnities to the Insured, based on the Claims Adjustment Report.

IMMEDIATE FAMILY MEMBERS

Father, Mother, Spouse, Brothers, Children, Partner and Partner.

PURPOSE OF INSURANCE

It is the generic designation of any insured interest, whether things, people, assets, responsibilities, obligations, rights or guarantees.

MANDATORY PARTICIPATION OF THE INSURED

Amount for which the Insured will be responsible, in the indemnity owed by the Insurer, due to a claimed claim, generally indicated by a percentage of the calculated losses and limited by a minimum amount.

TOTAL LOSS

There is a total loss of the insured object when it completely perishes or when it becomes, definitively, unsuitable for the purpose for which it was intended.

PERIOD OF INDEMNITY

It is the period during which the Insurer will reimburse certain expenses covered by the insurance. Generally, these expenses are related to rent or the consequences of interruption of professional activity.

LOSSÍZO

Value that represents the losses suffered by the assets or interests insured as a result of an event foreseen and covered in the policy.

AWARD

It is the amount paid by the Insured to the Insurer, so that it can assume the risks of the contracted insurance. Payment of the premium is essential to validate the insurance. PRESCRIPTION

Loss of the right to bring an action after the deadline established by law for claiming an interest has passed.

FIRST ABSOLUTE RISK

Term used to define the form of contracting coverage in which the Insurer is fully liable for damages, up to the amount of the Maximum Guarantee Limit (LMG), not applying, under any circumstances, an apportionment clause.

BIDDER

Natural or legal person willing to take out insurance with the Insurer.

INSURANCE PROPOSAL

It is the instrument that formalizes the applicant’s interest in taking out the insurance. It can be completed by the Insured itself, by its legal representative or by the insurance broker. The proposal must contain the essential elements of the interest of the risk to be guaranteed and the risk.

“PRO RATA TEMPORIS”

Reference to a type of calculation whose results are proportional to elapsed time. In insurance contracts, it is said

of the premium when it is calculated proportionally to the days already elapsed from the contract. ALLOCATION

It is the proportional co-participation of the Insured in the losses whenever these losses, determined at the time of the claim, are higher than the Maximum Indemnity Limit. It is a condition applicable only to some types of insurance.

CLAIMS ADJUSTMENT

It is the examination, in the event of an accident, of the causes and circumstances for characterizing the risk incurred and, in the light of these verifications, concluding on its coverage, as well as whether the insured has fulfilled all its legal and contractual obligations. REINTEGRATION

Recomposition of the reduced amount of the Maximum Indemnity Limit, related to one or more of the contracted coverages and the Maximum Limit of Guarantee of the policy, in the same proportion as it was reduced due to the indemnity paid.

RENOVATION

At the end of the term of an insurance contract, the Insured is normally offered the possibility of continuing the contract. The set of norms and procedures to be complied with, so that such continuity takes place, is called contract renewal.

TERMINATION

It is the breach of the insurance or reinsurance contract before its expiration date.

RISK

Possible, future, uncertain fact or event, independent of the will of the parties contracting an insurance, whose compensation is guaranteed by the Insurer.

RELATIVE RISK

Term used to define the form of contracting the coverage indicated when there is a probability that any property of the Insured, in a given location, will be affected by an event without total damage. The Insured establishes a Maximum Indemnity Limit (LMI) based on the value of the maximum probable damage, regardless of the declared value at risk (VRD), paying an increased premium whenever the LMI/VRD ratio is less than 01 (one). In the event of a claim guaranteed by this coverage, the Insurer will determine the real value of the assets (VRA) at the time and place of the claim and, if the VRD is less than 80% (eighty percent), the Insured will share in the losses proportionally .

TOTAL RISK

Term to define the form of contracting coverage in which the Insured at the time of contracting establishes the Maximum Limit of Indemnity (LMI) corresponding to the real (current) value of the assets guaranteed by it. In the event of a claim guaranteed by this coverage, the Insurer will determine the real value of the assets (VRA) at the time and place of the claim and, if the LMI of the coverage insurance is lower than the VRA, the Insured will share in the losses proportionally.

THEFT

Subtraction of someone else’s movable property, for oneself or for another, committed by serious threat or use of violence against the person, or after having, by any means, reduced him to the impossibility of resistance, either by physical action or by the application of narcotics, or armed robbery.

SAVED

They are tangible assets rescued from a claim, affected or not by material damage, which have been indemnified, and which have commercial value. They belong to the Insurer, upon payment of indemnity to the insured or to the beneficiary of the insurance. INSURED

It is the person, natural or legal, who, having an insurable interest, contracts the insurance and is exposed to the risks foreseen in the coverages indicated in the policy and defined in these General Conditions. When the insurance policy is issued, he changes from Proponent to being insured.

INSURER

Company legally constituted to assume and manage risks, duly specified in the insurance contracts and, in the event of an accident covered by the contracted policy, pays the indemnity.

SAFE

Operation that takes the legal form of a contract, in which one of the parties (Insurer) undertakes to

the other (insured or beneficiary of the insurance), upon receipt of an amount (premium), to compensate it for a loss (claim), resulting from a future, possible and uncertain event (risk) indicated in the general conditions, special conditions and clauses ratified in the policy.

SINISTER

It is the occurrence of a harmful event, affecting an Insured, foreseen and covered by the insurance contract. It is the realization of a covered risk. If it is not covered by the insurance contract, it is called excluded risk, not covered loss or not covered event.

SUBROGATION

Transfer to the Insurer of the rights and actions of the insured or the beneficiary of the insurance against the person causing the damages, up to the limit of the amount indemnified by the Insurer. THE 3RD

Any natural or legal person other than:

a) the insured person;

b) the cause of the accident;

c) employees, apprentices or contractors of the Insured, while at their service; or

d) partners, controllers, directors or administrators of the insured company.

CURRENT VALUE

It is the new value of an insured property, stolen or destroyed, after deducting the installments related to depreciation due to its use, age, condition and wear and tear.

VALUE AT RISK / VR

It is the full value of the insured asset or interest and/or the total cost of producing the event(s), informed in the insurance proposal and policy as Insurable Budget. In the case of coverage for Events, the Value at Risk declared by the insured must contain all costs attributable to the production of the insured event, such as: salaries, coordination, preparation, production and disassembly costs committed to carry out the event, general expenses, salary invoices, catering, entertainment, sound, travel, rental of spaces, activities, etc., including communication expenses (press campaigns, invitations…).